Is Workers Compensation Insurance Required in Florida

Workers Compensation Insurance and Employee Rights in Florida: What You Need to Know

Welcome, dear reader, to this informative and entertaining blog post brought to you by OCMI, the best workers comp insurance brokerage in the Sunshine State (in our humble opinion, of course).

Today, we will be discussing a topic that may not sound like the most thrilling of subjects, but is nonetheless of utmost importance: workers’ compensation insurance in Florida.

First Things First:

What is Workers' Compensation Insurance?

In case you are not familiar with the term, workers’ compensation insurance is a type of insurance that provides benefits to employees who are injured or become ill as a result of their job.

These benefits can include medical treatment, disability payments, and, in the worst-case scenario, death benefits to the employee’s family.

The idea behind workers’ compensation insurance is to ensure that employees who are injured on the job are not left to fend for themselves, and that employers are protected from lawsuits related to workplace injuries.

In other words, it’s a win-win situation for both parties.

Is Workers' Compensation Insurance Required in Florida?

Now, to answer the question at hand: is workers’ compensation insurance required in Florida?

The short answer is yes, it is. But as we all know, things are never that simple. So let’s take a closer look at the requirements for workers’ compensation insurance in the state of Florida.

Florida's Workers' Compensation Law

Florida’s workers’ compensation law requires most employers to provide workers’ compensation insurance coverage for their employees. The law applies to all employers who have four or more employees, whether full-time or part-time.

This means that if you have four or more employees, you are required to provide workers’ compensation insurance.

But wait, there’s more! There are some exceptions to this rule. For example, if you are a sole proprietor, a partner in a partnership, or a corporate officer in a corporation, you are not considered an employee and therefore do not need to provide workers’ compensation insurance for yourself.

However, if you have other employees working for you, then you must provide workers’ compensation insurance.

In addition to providing insurance coverage, employers are also required to keep records of all employees and their job-related injuries or illnesses. This includes a detailed description of the injury or illness and how it happened, as well as any medical treatment that was given. It is important that these records are accurate and up-to-date, as they can be used to prove that you have provided the necessary coverage for your employees.

Finally, it is essential to remember that workers’ compensation insurance is not just a financial protection; it also helps employers demonstrate their commitment to workplace safety.

By providing the necessary coverage for employees, employers are sending a strong message that they value the safety and wellbeing of their team. Additionally, employers may be able to qualify for discounts or other incentives on their premiums if they can prove that they have an effective safety program in place.

Regardless of the size of your business, workers’ compensation insurance is essential for protecting your employees and your business. Having the righ coverage can give you peace of mind and help ensure that your business runs smoothly.

It is important to review your policy regularly to make sure it is up-to-date, and contact an experienced insurance provider if you have any questions or concerns about the coverage you need for your business.

Who Needs Workers Compensation Insurance in Florida: Employer Obligations

Ah, the million-dollar question! Who needs Workers Compensation Insurance in Florida? Well, my friend, if you’re an employer with four or more employees (including yourself), then the answer is…drumroll please…you do!

Yes, even if you only have one part-time employee or a handful of seasonal workers, you still need to provide Workers Compensation Insurance. It’s a legal obligation, but it’s also just common sense.

After all, accidents happen, and you want to make sure you and your employees are covered in the event of an injury on the job. Trust us, your bank account (and your employees) will thank you.

How to Obtain Workers Compensation Insurance in Florida: Tips and Resources

Are you feeling overwhelmed by the thought of obtaining Workers Compensation Insurance in Florida? Fear not, dear reader, for OCMI is here to save the day!

Our team of experts knows all the tips and tricks for obtaining the right insurance coverage for your business. From determining the appropriate level of coverage to navigating the application process, we’ve got you covered. Plus, we’ve got a whole host of resources at our fingertips to help make the process as smooth as possible.

So why stress when you can leave it to the pros? Give OCMI a call today and let us handle the nitty-gritty details of your Workers Compensation Insurance.

The Consequences of Failing to Comply with Workers Compensation Insurance Requirements in Florida

Listen up, all you Florida business owners out there! Failing to comply with Workers Compensation Insurance requirements is no joke.

The consequences can be severe, from hefty fines to legal action and even the potential for your business to shut down entirely. That’s why it’s essential to get your Workers Comp coverage in order ASAP, and who better to turn to than the experts at OCMI?

We’ll make sure you’re fully compliant with all state regulations, so you can rest easy knowing your business is protected. Don’t let a lack of coverage put your business in jeopardy – contact OCMI today and let us take care of everything.

As an employer in Florida, it’s not just about protecting your own bottom line – you also have a responsibility to your employees. Workers Compensation Insurance is not only a legal requirement, but it’s also an essential protection for your staff in the event of a workplace injury or illness.

Your employees have the right to expect a safe and healthy work environment, and Workers Comp coverage is a crucial part of that. At OCMI, we’re passionate about helping employers understand their obligations to their employees and ensuring everyone is protected in the event of an accident. So let us help you do right by your team – contact OCMI today to get started.

Ah, Workers Compensation Insurance in Florida, the subject of many myths and misconceptions! Let’s set the record straight, shall we?

First off, some folks seem to think that Workers Compensation Insurance only covers injuries that occur on the job site. But here’s the thing, my dear friend, that’s simply not true.

In fact, Workers Compensation Insurance in Florida covers injuries that occur while an employee is on the clock, regardless of where the injury took place. So if Karen sprains her ankle while running an errand for the boss, or Steve throws his back out while working from home, they’re both covered by Workers Compensation.

Now, some people might think that if they’re injured on the job, they’ll automatically receive compensation without having to do anything. But unfortunately, that’s not quite how it works.

In order to receive Workers Compensation benefits, you’ll need to report your injury to your employer within 30 days of the incident. And if your claim is denied, you’ll have to appeal the decision in court.

Last but not least, let’s tackle the myth that Workers Compensation Insurance is a scam or a waste of money. Au contraire, mon ami!

Workers Compensation Insurance provides crucial financial support to employees who are injured on the job, covering medical expenses, lost wages, and even disability benefits in some cases. And for employers, having Workers Compensation Insurance in place can help protect them from costly lawsuits and legal fees.

So there you have it, the truth about Workers Compensation Insurance in Florida. Don’t believe everything you hear, folks!

Well folks, we’ve made it to the end of our journey through the land of Workers Compensation Insurance in Florida. It may not be the most thrilling topic, but it’s certainly an important one for business owners to understand.

Here at OCMI, we know that navigating the ins and outs of insurance requirements can be overwhelming, which is why we’re always here to help. Our team of experts is well-versed in the laws and regulations surrounding Workers Compensation Insurance, and we’re happy to answer any questions you may have.

In conclusion, yes, Workers Compensation Insurance is required for most employers in Florida. It’s a vital protection for both employees and business owners, and failing to comply with the law can result in serious consequences.

But don’t let the seriousness of the topic scare you away! With the right guidance and resources, obtaining Workers Compensation Insurance can be a straightforward and stress-free process.

So if you’re a business owner in Florida, don’t hesitate to reach out to the team at OCMI. We’ll make sure you have everything you need to protect yourself and your employees, and maybe even crack a few jokes along the way.

Are Volunteers Covered Under Workers Compensation in Florida?

Workers’ Compensation For Volunteers; volunteers play a vital role in many organizations, including non-profits, schools, and even government agencies.

They contribute their time and effort to help make a difference in their communities and the lives of others. However, as with any activity, there is always a risk of injury or accident occurring while volunteering.

This is why it is essential to understand the laws and regulations regarding workers’ compensation coverage for volunteers in Florida.

What is Workers' Compensation?

Workers’ compensation is a system designed to provide benefits to employees who are injured or become ill as a result of their work.

It provides medical treatment, wage replacement, and other benefits to help workers recover and return to work. Employers are required by law to provide workers’ compensation insurance to their employees, and employees are covered from their first day on the job.

However, the question arises whether volunteers are also covered under workers’ compensation insurance or not.

Workers' Compensation For Volunteers

The short answer is yes, volunteers in Florida are generally covered under workers’ compensation insurance. According to Florida law, “employee” is broadly defined to include volunteers who perform services for an employer or organization.

However, there are certain requirements that must be met for volunteers to be covered under workers’ compensation insurance. First, the volunteer must be working under the direction and control of the organization or employer. Second, the volunteer must not receive any compensation for their services, except for reimbursement of expenses.

If both of these requirements are met, then the volunteer is considered an “employee” under Florida law and is entitled to workers’ compensation benefits if they are injured while performing their volunteer duties.

What Types of Organizations Provide Workers' Compensation Coverage for Volunteers?

Most organizations, including non-profits, schools, and government agencies, are required to provide workers’ compensation coverage for their employees, including volunteers. However, there are some exceptions to this rule.

For example, certain religious organizations are exempt from providing workers’ compensation coverage to their employees, including volunteers. Additionally, small businesses with fewer than four employees are not required to provide workers’ compensation insurance.

It is also worth noting that some organizations may choose to provide workers’ compensation coverage for their volunteers, even if it is not required by law. This can help protect the organization from liability and ensure that volunteers receive the care and benefits they need in the event of an injury or accident.

What Benefits are Available Under Workers' Compensation for Volunteers in Florida?

Volunteers who are injured while performing their volunteer duties may be entitled to a variety of benefits under workers’ compensation insurance. These benefits may include:

- Medical Treatment: Workers' compensation insurance will cover the cost of medical treatment, including doctor's visits, hospitalization, and medication, related to the volunteer's injury.

- Wage Replacement: If the volunteer is unable to work due to their injury, workers' compensation insurance may provide wage replacement benefits to help cover lost wages

- Vocational Rehabilitation: If the volunteer is unable to return to their previous job due to their injury, workers' compensation insurance may provide vocational rehabilitation services to help them find a new job.

- Death Benefits: In the tragic event that a volunteer dies as a result of their injury, workers' compensation insurance may provide death benefits to their dependents.

It is important to note that workers’ compensation benefits are typically limited to medical expenses and a portion of lost wages. They do not cover pain and suffering or other damages that may be available in a personal injury lawsuit.

What Should Organizations Do to Ensure Volunteers are Covered Under Workers' Compensation?

Organizations that use volunteers should take steps to ensure that their volunteers are covered under workers’ compensation insurance.

This may include:

- Reviewing their workers' compensation insurance policy to ensure that it covers volunteers.

- Developing programs and procedures to ensure that volunteers are working under the direction and control of the organization.

- Providing adequate training and instruction to volunteers to help minimize the risk of injury while they are performing their duties.

- Making sure that volunteers have access to the same safety equipment that paid employees have, such as safety glasses or gloves.

- Having a system in place to promptly report any injuries to the organization's workers' compensation insurer.

- Taking all reasonable steps to protect volunteers from any hazards they may encounter while performing their duties.

- Ensuring that volunteers are aware of the organization's policies regarding workers' compensation insurance and the procedures for filing a claim if necessary.

- Educating volunteers on how to safely perform their duties and follow safety practices.

- Keeping records of training sessions and safety meetings, as well as any other relevant information related to the volunteers' work.

- Keeping an up-to-date list of emergency contacts in case a volunteer is injured while on duty.

- Making sure that supervisors and managers oversee volunteer tasks to ensure they are being performed safely.

- Ensuring that volunteers have access to health and safety information and materials.

- Providing regular feedback to volunteers regarding their progress in performing safe work practices.

- Ensuring that volunteers have the necessary protective clothing, equipment, and tools required for their tasks.

- Keeping track of any incidents or injuries that occur while a volunteer is on duty.

In conclusion, volunteers in Florida are generally not covered under workers’ compensation insurance. However, there are some exceptions to this rule, such as volunteer firefighters and emergency medical technicians.

Additionally, some organizations may choose to provide their own insurance coverage for volunteers, although this is not required by law.

It is important for both volunteers and organizations to understand the limitations of workers’ compensation insurance and to consider other options for protecting themselves and their volunteers.

By taking appropriate precautions and being aware of their legal rights and responsibilities, volunteers can continue to make valuable contributions to their communities without unnecessary risk.

Maximizing Your Workers’ Compensation Benefits

Five Tips and Strategies For Amplifying Workers Comp

Are you or someone you know dealing with a workplace injury? Being injured on the job can be a stressful and overwhelming experience, especially when it comes to navigating the workers’ compensation system.

However, there are steps you can take to ensure that you are maximizing your benefits and receiving the support you need during this difficult time.

In this blog post, we will provide you with five tips and strategies to help you get the most out of your workers’ compensation benefits.

From understanding your rights to communicating effectively with your employer and insurance company, we’ve got you covered. So, whether you’re just starting the process or have been dealing with a workplace injury for some time, keep reading to learn how you can optimize your benefits and move forward with confidence.

Understand Your Rights

The first step in maximizing your workers' compensation benefits is to understand your rights as an injured worker.

This includes knowing what benefits you are entitled to receive, how to file a claim, and what to expect throughout the process. Take the time to research your state’s workers’ compensation laws and regulations, and don’t be afraid to ask questions or seek legal advice if you need it.

Workers’ compensation is a system designed to provide benefits to employees who suffer injuries or illnesses as a result of their job.

To maximize these benefits, it’s crucial to understand your rights as an injured worker. This means knowing what types of benefits you’re entitled to receive, such as medical treatment, wage replacement, and vocational rehabilitation, and how to file a claim to receive them.

It’s also important to be aware of the deadlines for filing claims and appeals, as well as the steps involved in the claims process.

Researching your state’s workers’ compensation laws and regulations can help you navigate the process more effectively. Additionally, if you have questions or concerns about your claim, don’t hesitate to seek legal advice.

An experienced attorney can help you understand your rights, protect your interests, and maximize your benefits. By taking the time to educate yourself and seek assistance when necessary, you can ensure that you receive the full range of benefits you’re entitled to as an injured worker.

Report Your Injury Promptly

One of the most important things you can do after being injured on the job is to report the incident to your employer as soon as possible.

Waiting too long to report your injury could result in a delay or denial of your workers’ compensation benefits. Be sure to provide a detailed account of what happened and any injuries or symptoms you are experiencing.

Reporting your injury promptly is crucial to ensure that you receive the workers’ compensation benefits you’re entitled to.

Delaying the report of your injury could result in a loss of benefits or even a denial of your claim. By reporting the incident to your employer as soon as possible, you can ensure that they have the opportunity to investigate the incident and provide you with the necessary forms to file your claim.

Make sure to provide a clear and detailed account of the incident, including any symptoms or injuries you’re experiencing, to ensure that your claim is processed correctly and that you receive the appropriate benefits.

Seek Medical Treatment

If you have been injured on the job, it is essential to seek medical treatment right away.

Not only will this help you get the care you need, but it will also create a record of your injuries that can be used as evidence in your workers’ compensation claim. Be sure to follow your doctor’s orders and attend all appointments, as failing to do so could negatively impact your benefits.

Seeking medical treatment immediately after a workplace injury is crucial for both your health and your workers’ compensation claim.

By getting medical attention promptly, you can ensure that your injuries are properly diagnosed and treated, which can help you recover more quickly. Additionally, seeking medical treatment creates a record of your injuries, which can be used as evidence in your workers’ compensation claim.

It’s important to follow your doctor’s orders and attend all appointments, as failing to do so could be seen as a lack of cooperation and negatively impact your benefits. By prioritizing your health and following your doctor’s advice, you can increase your chances of a successful workers’ compensation claim.

Communicate Effectively

Effective communication is key when it comes to maximizing your workers' compensation benefits.

This includes keeping your employer and insurance company informed of your medical condition and any changes in your status. It’s also important to keep records of all communication, including emails, letters, and phone calls.

Communicating effectively with your employer and insurance company is essential to ensure that you receive the workers’ compensation benefits you’re entitled to.

Keeping them informed of your medical condition and any changes in your status can help to ensure that your claim is processed smoothly and that you receive the appropriate benefits.

It’s also important to keep records of all communication, including emails, letters, and phone calls, as these can be used as evidence in your claim.

By communicating clearly and keeping detailed records, you can help to avoid misunderstandings and ensure that your claim is processed correctly.

Stay Organized

Finally, staying organized is crucial when dealing with a workers' compensation claim.

Keep all documents and records related to your injury, including medical bills, receipts, and correspondence. This will help you keep track of your expenses and ensure that you are being reimbursed for everything you are entitled to receive.

Staying organized is essential to ensure that you receive all the benefits you’re entitled to and that your workers’ compensation claim runs smoothly.

Keeping all relevant documents and records, such as medical bills, receipts, and correspondence, will help you keep track of your expenses and provide evidence to support your claim.

This includes maintaining a diary or journal to document any medical appointments, symptoms, and progress. By staying organized, you can ensure that you have all the information you need at your fingertips and that you’re able to provide accurate and complete information to your employer and insurance company throughout the claims process.

In conclusion, dealing with a workplace injury can be a stressful and overwhelming experience. However, by following these five tips and strategies, you can maximize your workers’ compensation benefits and get the support you need to move forward. Remember to stay informed, communicate effectively, and stay organized, and don’t hesitate to seek legal advice if necessary.

Understanding Your Rights as an Injured Employee in Workers' Compensation

Five Things To Be Aware of As Injured Employee

Ah, workers’ compensation. It’s one of those things that nobody really wants to think about until they need it. And when that time comes, it can be overwhelming to navigate the ins and outs of the system.

But fear not, dear reader, for I am here to help you understand your rights as an injured employee in workers’ compensation.

Definition of Workers Compensation

First things first, let’s define what workers’ compensation actually is. In simplest terms, it’s a system that provides benefits to employees who are injured or become ill as a result of their job.

These benefits typically cover medical expenses and lost wages, among other things.

Now, onto the good stuff.

As an injured employee, you have certain rights when it comes to workers’ compensation. Here are a few key things to keep in mind:

If you're injured on the job, it's important to report it to your employer as soon as possible. Not only is this required by law in most states, but it also ensures that you're eligible for workers' compensation benefits. If you don't report your injury within a certain timeframe (which varies by state), you may lose your right to benefits.

Reporting your injury to your employer as soon as possible is critical to ensuring that you receive the workers’ compensation benefits that you’re entitled to. Failure to report your injury within a certain timeframe could result in a denial of your claim or a reduction in your benefits.

When reporting your injury to your employer, it’s important to be as detailed as possible. Explain exactly how the injury occurred and the extent of your injuries. You may also need to provide information about any witnesses to the accident or other relevant details.

Your employer may have specific forms or procedures for reporting workplace injuries, so be sure to follow their instructions carefully. You may need to fill out an accident report or other paperwork, so be sure to do that as soon as you can. The sooner you report your injury, the sooner your employer can begin the process of filing a workers’ compensation claim on your behalf.

Keep in mind that reporting your injury to your employer is not the same as filing a workers’ compensation claim.

You will still need to file a claim with the appropriate state agency to receive benefits. However, reporting your injury to your employer is the first step in the process and is critical to ensuring that you receive the benefits you’re entitled to.

In some cases, an employer may discourage or even retaliate against an employee who reports a workplace injury. It’s important to know that it’s illegal for an employer to retaliate against an employee for reporting an injury or filing a workers’ compensation claim. If you believe that your employer is retaliating against you, you may have legal recourse and should consult with an attorney.

In summary, reporting your injury to your employer as soon as possible is critical to ensuring that you receive the workers’ compensation benefits you’re entitled to.

Be sure to follow your employer’s procedures for reporting workplace injuries and provide as much detail as possible about the injury and how it occurred. And remember, it’s illegal for your employer to retaliate against you for reporting an injury or filing a workers’ compensation claim.

If you're injured on the job, your employer is typically required to provide you with medical treatment.

This may include doctor’s visits, hospital stays, and any necessary medical procedures. It’s important to keep track of all medical expenses related to your injury, as these may be covered by workers’ compensation.

It’s important to note that workers’ compensation laws vary by state, so it’s important to understand the specific requirements in your state. In general, however, workers’ compensation benefits typically include coverage for medical expenses, lost wages, and vocational rehabilitation.

Medical expenses may include doctor visits, hospital stays, medications, and physical therapy. Depending on the severity of your injuries, you may also be entitled to reimbursement for travel expenses related to medical treatment.

Lost wages benefits may include temporary disability benefits, which provide a portion of your regular wages while you’re unable to work due to your injury, and permanent disability benefits, which provide ongoing support if you’re unable to return to your previous job or perform certain tasks.

Overall, understanding your rights as an injured employee in workers’ compensation is critical to ensuring that you receive the benefits you’re entitled to.

If you're unable to work due to your injury, you may be eligible for temporary disability benefits.

These benefits typically cover a portion of your lost wages while you’re unable to work. In some cases, you may also be eligible for permanent disability benefits if your injury is severe enough to prevent you from returning to work.

Vocational rehabilitation benefits may include job training or education to help you return to work in a new capacity if you’re unable to return to your previous job.

It’s important to note that workers’ compensation benefits are typically limited to coverage for injuries or illnesses that are related to your job. If your injury was caused by your own actions, such as horseplay or drug use, you may not be eligible for benefits.

If your workers' compensation claim is denied, you have the right to appeal the decision.

This may involve a hearing before a judge or a review by an appeals board. It’s important to have all the necessary documentation and evidence to support your claim, as the burden of proof is typically on the employee.

The appeals process for workers’ compensation claims can vary by state, but in general, you will need to file a written appeal within a certain timeframe. This appeal may involve a hearing before an administrative law judge or a review by an appeals board.

During the appeals process, it’s important to have all the necessary documentation and evidence to support your claim. This may include medical records, witness statements, and other relevant information. The burden of proof is typically on the employee, so it’s important to present a strong case to support your claim.

If you’re considering appealing a denied workers’ compensation claim, it’s important to seek the advice of an experienced attorney who can guide you through the process and help you prepare a strong case.

An attorney can help you gather the necessary evidence, prepare for the hearing or review, and advocate on your behalf to help you receive the benefits you’re entitled to.

Overall, the right to appeal a denied workers’ compensation claim is an important protection for injured employees. By understanding your rights and the appeals process, you can help ensure that you receive the medical and financial support you need to recover from your injury and return to work.

Perhaps the most important right of all is the right to a safe work environment. Your employer is required by law to provide a safe workplace, free from known hazards.

If you believe that your injury was caused by unsafe working conditions, you may have the right to file a complaint with OSHA (the Occupational Safety and Health Administration).

Employers have a legal and ethical responsibility to ensure the safety of their employees. This includes providing proper training, safety equipment, and protocols to prevent accidents and injuries. If you feel that your workplace is unsafe, it’s important to speak up and notify your employer of any hazards or concerns.

If you’ve been injured due to unsafe working conditions, it’s important to report the incident to your employer and seek medical attention right away. You may also have the right to file a complaint with OSHA, which can investigate the incident and determine if any safety violations occurred. If OSHA finds that your employer failed to provide a safe work environment, they may issue citations or penalties.

Remember, you have the right to a safe work environment, and it’s important to advocate for yourself and your fellow employees to ensure that this right is upheld. By speaking up and reporting any unsafe conditions, you can help prevent accidents and injuries and create a safer workplace for everyone.

Of course, these are just a few of the rights that you have as an injured employee in workers’ compensation. The laws and regulations surrounding workers’ compensation vary by state, so it’s important to familiarize yourself with the specific rules that apply to you.

Six Steps to Take When Injured On the Job

So, what should you do if you’re injured on the job? Here are a few steps to take:

- Report your injury to your employer as soon as possible.

- Seek medical treatment for your injury.

- Keep detailed records of all medical expenses and lost wages related to your injury.

- File a workers' compensation claim with your employer or the appropriate state agency.

- If your claim is denied, consider appealing the decision.

- If you believe that your injury was caused by unsafe working conditions, file a complaint with OSHA.

It’s also a good idea to consult with a workers’ compensation attorney, especially if your injury is severe or your claim is denied. An attorney can help you navigate the complex legal system and ensure that you receive the benefits that you’re entitled to.

In conclusion, understanding your rights as an injured employee in workers’ compensation is essential. Knowing your state’s laws and filing the correct paperwork can help you get the compensation that you deserve.

With proper research and planning, you will be able to properly manage your injury claim and come out ahead in the end. Good luck!

Speak to one of our representatives today about getting your workers compensation. Or click on the button below to begin your quest!

Navigating the Complexities of Workers' Compensation Claims

Ah, Workers’ Compensation Claims, the delightful maze of paperwork and regulations that leaves everyone feeling a little lost and confused.

Whether you’re an employer trying to make sense of the system, or an employee trying to navigate the labyrinth of forms and deadlines, one thing is for sure – this is not a task for the faint of heart.

But fear not! With a little guidance and a touch of wit, we’ll help you navigate the complexities of Workers’ Compensation Claims and emerge victorious (or at least with a little less hair-pulling).

So, grab your coffee, take a deep breath, and let’s dive in!

Work Injury

Picture this: You’re at work, minding your own business, when suddenly – BAM! – you slip on a rogue banana peel and fall flat on your backside. Ouch.

Now, imagine if your employer didn’t have Workers’ Compensation Insurance. You’d be stuck with the medical bills, lost wages, and maybe even a permanent injury.

Yikes.

That’s why Workers’ Comp is like a superhero cape for employees – it swoops in to save the day when things go wrong on the job.

In this article, we’ll explore why Workers’ Comp is so important, and why every employer should have it in their arsenal of workplace safety measures. So, let’s suit up and get started!

Workers Comp Medical Benefits

Workers’ compensation in Florida covers medical treatment for injuries that are related to work.

This can include doctor visits, hospitalization, surgeries, physical therapy, and prescription medications.

Wage Replacement Benefits

If you are unable to work due to your injury, workers’ comp in Florida provides wage replacement benefits. These benefits are designed to replace a portion of your lost wages while you are unable to work due to your injury.

The amount of wage replacement benefits you may be entitled to depends on the severity of your injury and your average weekly wage.

What Is a Workers Comp Claim?

Well, my dear friend, a Workers’ Comp Claim is like a unicorn – you hear about it, you know it exists, but you’re never quite sure what it looks like in real life.

Basically, when an employee is injured on the job, they can file a claim to receive benefits to cover their medical expenses and lost wages.

It’s a bit like a genie in a bottle, but instead of granting wishes, it grants compensation. Of course, like any magical creature, there are rules and regulations to follow, and you need to know the secret handshake to get your hands on that sweet, sweet cash.

But don’t worry, we’ll guide you through the forest of forms and requirements to help you get the most out of your Workers’ Comp Claim. Just don’t expect any rainbows or fairy dust along the way – this is serious business, folks.

What Is Workers Comp?

First things first, let’s start with the basics. What exactly is Workers’ Compensation, you ask? Well, my dear Watson, it’s a system designed to provide benefits to employees who are injured on the job.

These benefits can include medical expenses, lost wages, and rehabilitation costs. Think of it as a safety net for workers, ensuring that they are taken care of in the event of an accident or injury while on the job.

But here’s the thing, folks – navigating the complexities of Workers’ Comp Claims is like trying to navigate a minefield blindfolded.

There are so many rules and regulations that it’s enough to make your head spin. And that’s why it’s so important to have a knowledgeable guide to help you through the process.

Why Workers Compensation Is Important

You need Workers’ Comp because, let’s face it, accidents happen. Even the most careful of employees can slip, trip, or fall (or get hit by a falling anvil, if you’re a cartoon character). And when those accidents result in injuries, someone’s got to pay the piper.

That’s where Workers’ Comp comes in, like a trusty sidekick to save the day. It helps cover the costs of medical treatment, lost wages, and even rehabilitation for those who are injured on the job.

So, what exactly are some of the complexities you’ll face when filing a Workers’ Comp Claim? Well, for starters, there are a whole host of forms to fill out, deadlines to meet, and regulations to follow. And if you miss just one little detail, your claim could be denied faster than you can say “oops”.

But don’t worry, my dear friends, because I’m here to help you through the process. So let’s start with the basics – the forms.

There are a lot of forms to fill out when filing a Workers’ Comp Claim, and each state has its own specific forms and regulations. But don’t panic – you don’t have to go it alone. Most states have Workers’ Compensation offices that can provide you with the necessary forms and information to get started.

One of the most important forms you’ll need to fill out is the Employee Claim Form. This is the form that initiates the Workers’ Comp Claim process and provides the basic information about your injury and how it occurred. Make sure to fill out this form completely and accurately, and don’t forget to include any and all medical documentation related to your injury.

Next up is the Employer’s First Report of Injury or Illness. This is the form that your employer fills out to report your injury to their Workers’ Comp insurance carrier. It’s important that this form is filled out in a timely manner, so make sure to remind your employer if they haven’t submitted it yet.

There are also forms for your doctor to fill out, including the Doctor’s First Report of Injury or Illness and the Physician’s Progress Report. These forms provide important information about your medical treatment and can help support your Workers’ Comp Claim.

Now, here’s where things can get a little tricky. Each state has its own specific deadlines for filing Workers’ Comp Claims, so it’s important to make sure you know what those deadlines are and that you meet them. In some states, you only have a few days to report your injury to your employer, while in others you may have up to a year. Make sure to check with your state’s Workers’ Compensation office to find out what the deadlines are and to make sure you don’t miss them.

And if all of that wasn’t enough to make your head spin, there are also regulations that govern the type and amount of benefits you can receive through Workers’ Comp. These regulations can vary by state, but in general, they cover things like how much you can receive in medical benefits and how long you can receive wage replacement benefits.

But don’t worry, my friends, because I’m here to help you navigate these regulations and make sure you receive the benefits you deserve.

One of the most important things to keep in mind when filing a Workers’ Comp Claim is to be honest and accurate about your injury and how it occurred. Falsifying information or exaggerating your injury can not only lead to your claim being denied, but it can also have legal repercussions.

Another important aspect of navigating the complexities of Workers’ Comp Claims is working with a knowledgeable and experienced attorney. An attorney can help guide you through the process, ensure that your rights are protected, and help you get the maximum benefits you are entitled to. They can also help you appeal a denied claim or negotiate a settlement if necessary.

But, my friends, be careful when choosing an attorney. Not all attorneys are created equal, and it’s important to find someone who has experience specifically in Workers’ Comp Claims. Do your research, read reviews, and ask for referrals to find an attorney who can help you navigate the complexities of the process.

So, there you have it, folks – a crash course in navigating the complexities of Workers’ Compensation Claims. It’s a tricky and confusing process, but with a little guidance and a lot of patience, you can get the benefits you deserve. And remember, always be honest and accurate in your reporting, meet all deadlines, and work with a knowledgeable attorney to ensure that your rights are protected.

So, if you want to protect yourself, your employees, and your bottom line from the unexpected, you better have Workers’ Comp by your side. Trust me, it’s a hero you’ll be glad to have in your corner.

What Happens if You Quit Your Job While on Workers Comp in Florida?

Workers’ compensation is a form of insurance that provides medical and wage benefits to employees who are injured on the job.

If you are injured while working in Florida, you may be entitled to receive workers’ compensation benefits. However, what happens if you decide to quit your job while receiving workers’ compensation benefits?

In this blog post, we will explore the consequences of quitting your job while on workers’ comp in Florida.

Workers' Comp Benefits in Florida

Before we delve into the consequences of quitting your job while on workers’ comp in Florida, let’s first understand what benefits you may be entitled to.

Florida law requires most employers to provide workers’ compensation insurance to their employees.

Workers’ comp benefits include medical treatment, wage replacement, and other benefits to help injured employees recover from their injuries.

Workers Comp Medical Benefits

Workers’ compensation in Florida covers medical treatment for injuries that are related to work.

This can include doctor visits, hospitalization, surgeries, physical therapy, and prescription medications.

Wage Replacement Benefits

If you are unable to work due to your injury, workers’ comp in Florida provides wage replacement benefits. These benefits are designed to replace a portion of your lost wages while you are unable to work due to your injury.

The amount of wage replacement benefits you may be entitled to depends on the severity of your injury and your average weekly wage.

Other Workers Comp Benefits

In addition to medical and wage replacement benefits, workers’ comp in Florida may provide other benefits such as vocational rehabilitation and death benefits.

Consequences of Quitting Your Job While on Workers' Comp in Florida

If you are receiving workers’ compensation benefits and decide to quit your job, there are several consequences you should be aware of.

Loss of Wage Replacement Benefits

If you quit your job while receiving workers’ comp benefits, you will likely lose your wage replacement benefits. This is because wage replacement benefits are designed to replace a portion of your lost wages while you are unable to work due to your injury.

If you quit your job, you are no longer considered to be “unable to work” due to your injury, and you will no longer be entitled to receive wage replacement benefits.

If you quit your job while receiving workers’ comp benefits, you may also lose your medical benefits.

In Florida, workers’ comp benefits are designed to cover medical treatment for injuries that are related to work.

If you quit your job, your injury may no longer be considered “work-related,” and you may no longer be entitled to receive medical benefits.

If you quit your job while receiving workers’ comp benefits, you may also be at risk of being overpaid.

Overpayment occurs when an injured worker receives more benefits than they are entitled to.

If you quit your job, you may no longer be entitled to receive workers’ comp benefits, and any benefits you receive after quitting may be considered overpayment.

If you quit your job while receiving workers’ comp benefits, you may also lose your job protection.

In Florida, injured workers who are receiving workers’ comp benefits are protected from retaliation by their employer. This means that your employer cannot fire you or discriminate against you because you filed a workers’ comp claim. However, if you quit your job, you may lose this job protection, and your employer may be able to terminate your employment without consequences.

If you quit your job while receiving workers’ comp benefits, it may also impact your ability to settle your workers’ comp claim.

In Florida, injured workers can settle their workers’ comp claims with their employer or the workers’ comp insurance company.

If you quit your job, your employer or the insurance company may be less willing to settle your claim, as they may view your decision to quit as a sign that your injury is not as severe as you claim.

In addition, the settlement amount may be lower than it would have been if you had stayed in your job and continued to receive workers’ comp benefits.

Bottom Line

If you are an injured employee receiving workers’ comp benefits, it is important that you understand the potential consequences of quitting your job before making a decision.

Quitting your job before settling a workers’ comp claim may result in lower settlement amounts and difficulty negotiating with the insurance company.

It is important that you consult with an experienced workers’ comp attorney to ensure that your rights are protected and that you receive the full amount of compensation you deserve.

The first step in recovering workers’ comp benefits is filing a petition with the state labor board. Your attorney can help you prepare and file a petition, as well as represent you during hearings and negotiations.

Your attorney can also advise you on the best course of action for your specific situation and ensure that all legal considerations are taken into account. Ultimately, it is up to you to decide whether quitting your job is in your best interest, but having a knowledgeable attorney on your side can make the process much smoother.

Good luck!

How Do I Know if I Need Workers’ Compensation Insurance?

What is Workers’ Compensation Insurance and What Does it Cover?

Workers’ compensation insurance is like a simplified version of the classic game show Price is Right for business owners.

On this show, instead of prizes being given away, employers get reimbursed for losses due to work-related injuries or illnesses that occur to their employees. Just as on Price Is Right, there are certain rules and regulations that must be followed in order to receive the maximum compensation.

Depending on the type of coverage selected by the employer, workers’ compensation may pay for medical expenses related to job ailments, such as physical or occupational therapy, transportation costs for medical appointments, lost wages due to temporary disability that were caused by an injury at work, and even death benefits if an unfortunate incident leads to the demise of an employee.

It’s definitely better to be safe than sorry when it comes to workers’ compensation insurance – you don’t have to suffer through a painful injury just to find out your loved one isn’t eligible for proper coverage!

How Do I know if I Need Workers Compensation For My Business?

Trying to decide whether you need workers comp for your business can seem daunting, but it doesn’t have to be. The answer comes down to one simple question: do you have employees?

Depending on if it is a high-risk work environment and if the answer is yes, then you absolutely need to secure workers comp coverage – and pronto!

Otherwise, you may be in store for a host of unintended problems that could cost you time, money and your peace of mind. But don’t take our word for it – while there may be a hefty price tag involved with setting up compulsory workers comp coverage, the cost of not having it is much higher.

Not feeling a rush of risk in your small business? If it’s got fewer than four employees, you may have one less thing to worry about: workers comp exemption!

Florida Law states that if your small business has fewer than four employees, you can breathe a sigh of relief — there’s one less thing to worry about! Workers comp exemption? Check. Not feeling that rush of risk anymore? Then you’re all set! Leave the tightrope feeling to acrobats and high wire acts — keep running a successful small business!

What Are The Benefits of Having Workers’ Compensation Insurance in Place?

Workers’ compensation insurance provides a safety net for employees in case they encounter workplace accidents or illness. This protection is invaluable and keeps businesses on the right side of the law. Furthermore, it offers an incentive to workers that their medical costs will be covered if misfortune strikes.

Not only does it put minds at ease knowing support is there if needed, but also more money in pockets because bills don’t pile up.

Even better, employers who possess workers’ compensation insurance can take pride in the fact that they are providing a very important safeguard for their staff. So really, when you think about it, having this type of insurance in place is really worth its weight – quite literally!

How Much Will it Cost Me To Get Coverage For My Employees?

Health insurance is the gift that keeps on giving, for employers and employees alike. And while premiums can sometimes be a costly investment with varying prices, generally speaking you’re looking at an average of $6k-$16k to ensure your staff are well taken care of – not just physically but mentally as having health coverage gives them peace-of-mind knowing they’ll always have access to quality medical support whenever needed!

Make your business a beehive of happiness with group health insurance plans!

Offering coverage to employees – and sweetening the pot by saving on taxes too – is an excellent way for companies to build up their staff.

Get buzzin’ today, pick out the perfect plan, and let everyone enjoy all the benefits that come along with it.

The cost of providing health insurance to your employees is like a box of chocolates; you never quite know what you’re gonna get! From the type and location of plan, features offered, employee demographics and more – there are many variables that come into play when it comes to calculating premiums.

So pick up those calculators – let the crunching begin!

How Can I Get a Quote For Workers’ Compensation Insurance Coverage?

Shopping for workers’ compensation insurance coverage doesn’t have to be a daunting task. Utilizing price comparison sites, brokers, or even going straight to carriers can help you get the best quote.

If you’re feeling extra wallet-friendly, shop the competition in the insurance market to get a quote that’s right for your business.

Before committing to any plan, read through it carefully and understand what kind of coverage you will receive before signing on the dotted line to ensure your business is adequately protected.

Make sure you get a quote that works with your budget but also offers proper protection for all aspects of your business operations.

No two businesses are the same, which is why insurance companies take a variety of factors into account when it comes to setting workers’ comp rates.

From your payroll size and industry type to what kind of work your employees do and claims history – all these elements come together like pieces of a puzzle to decide how much you’ll pay in premiums.

Insurance costs may skyrocket if you have a claims-heavy track record – the National Council on Compensation Insurance can assign your business an extra costly classification code based on the type of job activity. Yikes!

Why Get Workers Compensation?

As with everything else, when it comes to workers comp, you should research which company works best for you and your team. There are a lot of great options out there, but if you’re looking for reliable coverage that won’t break the bank, OCMI might be the perfect fit.

Not only do we offer competitive rates and bonuses, but our customer service team is well-informed and helpful when needed. Plus, our program’s claim process is speedy and efficient, so there are no delays in getting compensation if something does go wrong.

So if you’d like to make sure that your employees receive the support and peace of mind they deserve, then investing in a quality workers comp program could be the way to go — especially one provided by OCMI!

Difference Between Exempt and Non-Exempt Employees?

We all know that no two jobs are created equal. But what about when it comes to employee status?

Understanding the difference between exempt and non-exempt employees can be critical for companies, their employees, and those who oversee their compliance with employment law. It’s an exploration of logistics meant to ensure employers pay workers properly: something I think we can all celebrate!

Let’s keep digging, so your business stays up-to-date with its rules around exemptions. After all, legal obligations should never stand in the way of taking care of your team!

As workers compensation Florida regulations become more complex, business owners are faced with the difficult decision of investing in workers comp or not.

While workers comp may seem like a heavy expense for a small business needing to maximize every dollar, it can be an invaluable investment in their workers’ safety and getting them back to work as quickly as possible should an accident occur.

Not only that, but without workers comp some businesses can be held liable for certain expenses associated with workplace injuries that may extend far beyond workers’ fatalities or incapacity due to injury. In summary, workers comp is worth the investment for business owners looking to protect their workers – and their wallets!

What Is An Exempt Employee?

Exempt employees are workers who are not eligible to receive workers compensation under the laws of Florida. Really, they might as well be labeled as ‘exempt from workers comp’, since that’s basically their chief distinction!

Many business owners want to ensure that their workers are compensated in the event of a workplace accident or illness, so investing in workers comp for their nonexempt employees is essential. But for the exempt employee, there’s no compensation involved–you just have to hope you don’t get hurt!

What Are Nonexempt Employees?

Nonexempt employees may sound like some kind of superhero crime fighting squad, but in reality they’re just the everyday working folks here in Florida!

These Florida workers exempt from Florida workers comp are not necessarily caped and ready to leap tall buildings; instead, they are the employees that most companies have – the people who go to work every day and put forth the hard labor that makes their employers successful.

So while nonexempt employees might lack supernatural power and fancy costumes, don’t underestimate them, as their importance should never be overlooked.

When an individual is labeled as a nonexempt employee, they are also eligible for workers comp if they incur an injury while completing work related tasks. Becoming aware of this status ensures employers meet the expectations of workers who fit into the nonexempt category.

Nonexempt employees receive minimum wage and overtime pay, based on the precise hours worked in each pay period. When eligible for overtime compensation – determined according to federal- and state guidelines – these workers are paid at 1.5 times their normal hourly rate of pay.

What Types Of Stipulations Does The FLSA Have?

The Fair Labor Standards Act (FLSA) is really the workers’ friend, with workers compensation Florida regulations that ensure businesses comply with fair standards in wages and working conditions. This includes setting the minimum wage, ensuring workers comp coverage for on-the-job injuries, and limiting age restrictions when it comes to children working.

However, certain states and cities have additional labor laws that may provide workers with even more favorable wages than those set by FLSA – employers must always follow whichever guarantees employees a greater benefit!

Business owners may think their workers are just wily ways for the government to get involved, but long term benefits mean these laws have become a standard across many industries today – giving workers both financial security and peace of mind.

Do Exempt Employees Qualify For Minimum Wage?

In the State of Florida, employees in certain job classifications are exempt from demanding minimum wage and overtime rules. Such exemptions provide professionals with more freedom to create their own terms for pay rate and working hours.

Knowing which career field you’re employed in is essential when it comes to understanding your rights as an employee—here’s a breakdown of what qualifies someone as exempted!

Eligible executive employees in Florida have a unique opportunity to enjoy the privilege of being exempt from both minimum wage and overtime regulations. With responsibility for directing work at departments or sub-departments with two full-time subordinates under their command, they are uniquely positioned to capitalize on this benefit.

In Florida, supervisors and employees with primary managerial duties are considered exempt. This means that you have unique responsibilities involving hiring, firing, and other supervision-related activities. Having a role in the executive realm reflects an important position among your coworkers!

Navigating a job in the computer industry can be tricky, especially for those looking to land positions as software developers or programmers. But it’s good news! Florida employees who make their living from ICT-related work are off the hook when it comes to minimum wage requirements – so long as they know how to clear certain hurdles along their path.

Salaried professionals must be paid a weekly wage of more than $684, equating to an hourly rate higher than $27.63 – and they should have some degree of responsibility when it comes to developing or shaping computer systems. This could include designing software programs, writing code, testing procedures, digitally modifying hardware components – you name it!

Florida executive administrators have the unique opportunity to be exempt from minimum wage and overtime compensation, as covered by The Fair Labor Standards Act. These employees are tasked with various administrative duties in their places of work – ensuring a smooth daily operation!

If you’re looking to get a job that offers an administrative position exemption, the sky is the limit! To be eligible for this sort of reward, you must qualify with a minimum weekly salary of $684 and your daily duties should revolve around non-manual tasks related to business operations.

From account management to labor relations and beyond – countless positions can provide employees with impressive benefits like exemptions on their taxes. So fuel your career up by putting yourself in line for these coveted titles now!

Exempt from overtime and minimum wage requirements under the FLSA, certain occupations may be exempt including those working in retail or service commissioned roles.

Auto salespersons, parts employees for vehicles and vessels such as boats or aircrafts are also classified as exempt when paid on approved trip rate plans. Exemption continues with movie theater workers, domestic help residing at their employer’s residence plus farmworkers involved in agricultural operations while fishing personnel along American seaways might not have to comply either.

How Long Does it Take to Get Workers Comp in Florida?

If you or one of your employees have been injured in a workplace accident and are looking to receive workers’ comp benefits, you may be asking yourself ‘how long is this going to take?’

All too often, the process of getting these important benefits can seem like an eternity. Fortunately for Floridians, the answer isn’t as long – but still not short – as you may think.

In this blog post, we’ll explain step-by-step how it works and give you an idea of just how long it takes to receive workers’ comp in Florida.

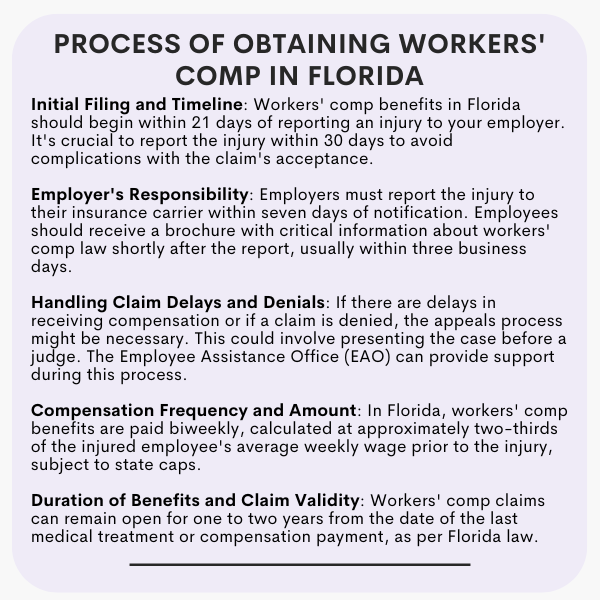

After you have reported an injury to your employer, Floridian law dictates that workers’ comp benefits will start flow within 21 days. That’s right – just three short weeks and you’ll be the proud owner of a brand new check!

When Should I File A Workers Compensation Claim?

To ensure your claim is accepted, report it within thirty days – the longer you wait, the less likely you are to have a successful outcome.

Should My Employer Report My Claim?

After an injury on the job, your employer should promptly report it to their insurance carrier within seven days of becoming aware.

Along with this notification comes a brochure outlining key information about workers' compensation law that you need to be aware of – and fast! The insurer must send out the materials right away, usually arriving in three business days or less.

For deeper insight into system specifics and procedures, check-out the “Brochures” section on the Myfloridacfo.com website, where the same informational packet can also be found.

Filing A Workers Comp Claim

Although fast claims processing times are possible, don't be surprised if your insurance company pays its due diligence in reviewing and denying the claim. Be ready for unexpected delays to ensure you get the coverage you deserve!

If a workers’ comp payment is delayed, the appeals process may need to be initiated. Unfortunately, this could mean having to take matters into your own hands and presenting your case before a judge in order for it to be resolved quickly.

What If My Employer Does Not Report My Injury?

You have the right to report a workplace injury in Florida, as per Section 440.185 of the state statutes.

If you require help with this process however, please don’t hesitate to contact the Employee Assistance Office (EAO). They can be reached by phone at 800-342-1741 or via email at wceao@myfloridacfo.com – get back on your feet and protect yourself today!

What If My Workers Compensation Claim Is Denied?

When facing a dispute, it's important to be aware of the assistance that is available.

The Employment Assistance Office (EAO) provides no-cost services, including helping you attempt to resolve your issue and filing petitions for benefits when needed – all without hiring an attorney.

For further information, contact us at (800) 342-1741 or by e-mailing wceao@myfloridacfo.com; we also have District Offices located throughout Florida as well!

How Often Does Workers Compensation Pay?

In Florida, workers comp benefits are tailored to fit the individual. After an on-the-job injury or illness, benefit checks arrive biweekly and provide financial relief based off each person's average weekly wage.

If you were injured on the job, your benefit check could be up to two-thirds of what you made during a three month period just before that injury – as long as it doesn’t exceed state limits. This money is often paid out in bi-weekly installments.

Will I Be Paid If I Lose Time From Work?

Are you facing a disability in Florida?

Be aware that according to state law, benefits are not paid out for the initial seven days of disablement. However, if your condition remains longer than three weeks and continues into day eight or beyond, then insurance may provide payment for those first few days.

How Long Does My Workers Comp Claim Remain Open?v

How Long Does My Workers Comp Claim Remain Open?

Depending on when the injury occurred, this could be either one or two years from either your last medical treatment or payment of compensation – as outlined by Section 440.19(2) in Florida State Law. Don’t miss out!

What is Pay As You Go Workers Comp?

Pay As You Go Workers Comp is an innovative insurance coverage solution that enables businesses to reduce the cost of providing workers compensation coverage while remaining compliant with state and federal laws.

It provides short-term workers comp coverage for any company, giving them the flexibility to meet their needs in a timely manner. With this option, companies are able to cover their employees at a fraction of the cost associated with traditional policies.

In addition, Pay As You Go Workers Comp allows employers to keep track of their employees’ claims and payments, allowing them to stay on top of any potential risks or liabilities.

This type of insurance can also be beneficial for companies who are subject to changing needs due to seasonal fluctuations or other unexpected changes in demand.

By taking advantage of Pay As You Go Workers Comp, businesses can ensure they’re always covered while keeping costs low.

How Does Pay As You Go Workers Comp Work?

Pay as you go workers comp is a great way for businesses to manage their workers compensation liabilities and costs.

OCMI can help with this, by providing coverage through the state’s workers comp program with real-time payments that are calculated and made throughout the year.

This type of plan allows employers to easily budget their workers comp payments and eliminates large end-of-year bills that can be difficult to manage. By working with OCMI, employers can pay premiums in fixed monthly or quarterly installments based on their current payroll and estimated future payroll amounts.

The company will then adjust the premium payments as necessary for any changes in payroll numbers, so employers are always paying the appropriate amount for their coverage needs.

Additionally, OCMI also offers access to an online portal that makes managing policies and reporting claims easier than ever before. With this kind of convenience, plus the flexibility of pay as you go workers comp plans, it’s no wonder why more businesses are turning to OCMI for their coverage needs!

How can Pay As You Go Workers Comp help businesses save money on workers compensation insurance premiums?

Pay As You Go Workers Comp is an innovative way for businesses to save money on their workers compensation insurance premiums.

By utilizing this system, businesses can pay for the exact amount of coverage they need as they go – rather than having to pre-pay for the year in one lump sum. This means that if a company’s payroll changes throughout the year, their premium payments will adjust accordingly. Additionally, because the premium is based on actual payroll, employers will not have to pay more than what’s required and can rest assured that they are paying a fair rate.

Pay As You Go Workers Comp also allows businesses to make payments via ACH or credit cards with no additional processing fees.

Overall, Pay As You Go Workers Comp offers significant financial benefits over traditional workers compensation insurance plans and provides employers with peace of mind knowing that they are only paying what’s necessary to provide adequate coverage for their employees.

What Are The Benefits of Using Pay As You Go Workers Comp for Businesses?

Pay As You Go Workers Comp is an incredibly beneficial option for businesses large and small.

It allows businesses to pay their workers comp premium on an ongoing basis, as it accrues, relieving them of the burden of a lump sum payment.

This means that businesses can budget more effectively, avoiding the financial strain of needing to cover an unexpected bill for their workers comp premiums. Additionally, this type of system offers businesses greater flexibility in terms of how much they need to pay each month.

With Pay As You Go Workers Comp, businesses only have to pay for what they are using at any given time and can adjust their payments easily when needed.

Furthermore, because workers comp premiums are based on current wages rather than the total payroll number, businesses can save money by taking advantage of lower commissions when their employees’ salaries increase.

Finally, Pay As You Go Workers Comp helps create a safer workplace by ensuring that employers are up-to-date with their workers compensation insurance coverage and helping employers make sure that all safety regulations are met.

How Can Businesses Get Started With Pay As You Go Workers Comp?

Businesses can get started with Pay As You Go Workers Comp by consulting a OCMI Workers Comp to find out what their options are.

To get started, businesses should research the best-rated providers and compare their coverage plans, pricing structure, and customer service reviews.

Businesses should also investigate how much coverage they need for each employee and any additional benefits that may be offered with the plan.

Employers should also consider the convenience of setting up automatic payments through the provider to make sure their premiums are paid on time each month.

Ultimately, Pay As You Go Workers Comp provides businesses with an affordable way to stay compliant with workers compensation regulations and protect employees in case of injury or illness while on the job.

Are there any drawbacks to using Pay As You Go Workers Comp?

One of the primary drawbacks to using Pay As You Go Workers Comp is that it can be expensive.

This is due to the fact that employers are required to pay for workers comp coverage on a regular basis and cannot take advantage of lower premiums that may be available if they were able to pay for an annual policy in advance.

Additionally, some employers may not have the cash flow necessary to sustain regular payments and may be unable to afford a comprehensive workers comp policy.

Lastly, not all states allow Pay As You Go Workers Comp, so employers in those states will have no choice but to obtain traditional annual policies or risk getting fined or having their business shut down.

Now that you know all about Pay As You Go Workers Comp, does it sound like something your business could benefit from? If you’re interested in learning more about how OCMI can get you the best workers comp rates, give us a call or fill out our online form to request a quote.

We’d be happy to answer any questions you have and help you get started with this cost-saving solution for your business.