How Long Does Workers' Comp Last in Florida? How Long Does It Take to Get Workers' Comp Checks?

If you or an employee has been injured in a workplace accident, you might be wondering how to get workers’ comp in Florida and how long the process will take. Understanding these timelines is crucial to ensure you receive the benefits you’re entitled to under Florida law.

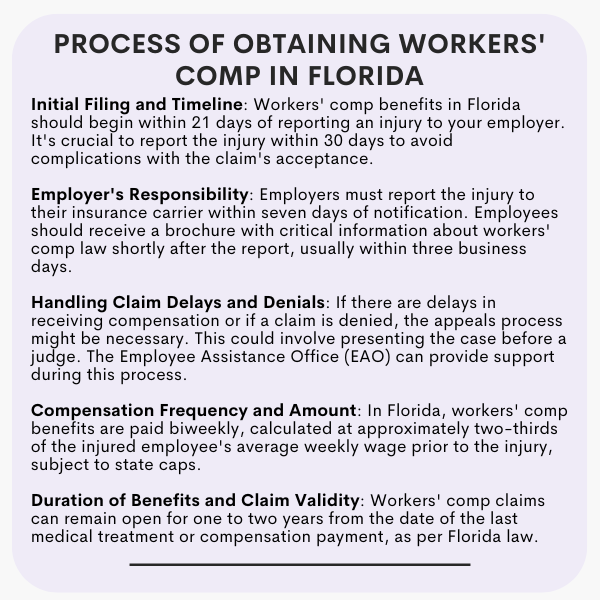

In Florida, workers’ comp benefits aim to provide timely support for injured workers. After reporting an injury to your employer, you can expect the first workers’ comp check to arrive within 21 days, provided the claim is approved. This relatively quick turnaround helps injured employees focus on recovery rather than financial stress.

The length of time workers’ comp benefits last in Florida depends on the nature and severity of the injury. Temporary benefits can last up to 104 weeks, while permanent benefits may continue for much longer, depending on the circumstances.

How to Get Workers’ Comp in Florida

The process starts with promptly reporting the injury to your employer. To improve your chances of a smooth claims process, it’s essential to file the claim within 30 days of the incident. Delays can complicate approval and may reduce your likelihood of receiving benefits.

Workers’ comp in Florida is designed to assist injured workers in covering medical bills and lost wages. By following the proper steps and adhering to timelines, you can ensure the process goes as smoothly as possible.

When Should You File a Workers' Compensation Claim?

To maximize your chances of a successful claim, report any workplace injury immediately and file your claim as soon as possible. Florida law requires claims to be reported within 30 days of the injury. Waiting too long can jeopardize your ability to receive benefits.

Should My Employer Report My Claim?

After an injury on the job, your employer should promptly report it to their insurance carrier within seven days of becoming aware.

Along with this notification comes a brochure outlining key information about workers' compensation law that you need to be aware of – and fast! The insurer must send out the materials right away, usually arriving in three business days or less.

For deeper insight into system specifics and procedures, check-out the “Brochures” section on the Myfloridacfo.com website, where the same informational packet can also be found.

Filing A Workers Comp Claim

Although fast claims processing times are possible, don't be surprised if your insurance company pays its due diligence in reviewing and denying the claim. Be ready for unexpected delays to ensure you get the coverage you deserve!

If a workers’ comp payment is delayed, the appeals process may need to be initiated. Unfortunately, this could mean having to take matters into your own hands and presenting your case before a judge in order for it to be resolved quickly.

What If My Employer Does Not Report My Injury?

You have the right to report a workplace injury in Florida, as per Section 440.185 of the state statutes.

If you require help with this process however, please don’t hesitate to contact the Employee Assistance Office (EAO). They can be reached by phone at 800-342-1741 or via email at wceao@myfloridacfo.com – get back on your feet and protect yourself today!

What If My Workers Compensation Claim Is Denied?

When facing a dispute, it's important to be aware of the assistance that is available.

The Employment Assistance Office (EAO) provides no-cost services, including helping you attempt to resolve your issue and filing petitions for benefits when needed – all without hiring an attorney.

For further information, contact us at (800) 342-1741 or by e-mailing wceao@myfloridacfo.com; we also have District Offices located throughout Florida as well!

How Often Does Workers Compensation Pay?

In Florida, workers comp benefits are tailored to fit the individual. After an on-the-job injury or illness, benefit checks arrive biweekly and provide financial relief based off each person's average weekly wage.

If you were injured on the job, your benefit check could be up to two-thirds of what you made during a three month period just before that injury – as long as it doesn’t exceed state limits. This money is often paid out in bi-weekly installments.

Will I Be Paid If I Lose Time From Work?

Are you facing a disability in Florida?

Be aware that according to state law, benefits are not paid out for the initial seven days of disablement. However, if your condition remains longer than three weeks and continues into day eight or beyond, then insurance may provide payment for those first few days.

How Long Does My Workers Comp Claim Remain Open?v

How Long Does My Workers Comp Claim Remain Open?

Depending on when the injury occurred, this could be either one or two years from either your last medical treatment or payment of compensation – as outlined by Section 440.19(2) in Florida State Law. Don’t miss out!

What is Pay As You Go Workers Comp?

Pay As You Go Workers Comp is an innovative insurance coverage solution that enables businesses to reduce the cost of providing workers compensation coverage while remaining compliant with state and federal laws.

It provides short-term workers comp coverage for any company, giving them the flexibility to meet their needs in a timely manner. With this option, companies are able to cover their employees at a fraction of the cost associated with traditional policies.

In addition, Pay As You Go Workers Comp allows employers to keep track of their employees’ claims and payments, allowing them to stay on top of any potential risks or liabilities.

This type of insurance can also be beneficial for companies who are subject to changing needs due to seasonal fluctuations or other unexpected changes in demand.

By taking advantage of Pay As You Go Workers Comp, businesses can ensure they’re always covered while keeping costs low.

How Does Pay As You Go Workers Comp Work?

Pay as you go workers comp is a great way for businesses to manage their workers compensation liabilities and costs.

OCMI can help with this, by providing coverage through the state’s workers comp program with real-time payments that are calculated and made throughout the year.

This type of plan allows employers to easily budget their workers comp payments and eliminates large end-of-year bills that can be difficult to manage. By working with OCMI, employers can pay premiums in fixed monthly or quarterly installments based on their current payroll and estimated future payroll amounts.

The company will then adjust the premium payments as necessary for any changes in payroll numbers, so employers are always paying the appropriate amount for their coverage needs.

Additionally, OCMI also offers access to an online portal that makes managing policies and reporting claims easier than ever before. With this kind of convenience, plus the flexibility of pay as you go workers comp plans, it’s no wonder why more businesses are turning to OCMI for their coverage needs!

How can Pay As You Go Workers Comp help businesses save money on workers compensation insurance premiums?

Pay As You Go Workers Comp is an innovative way for businesses to save money on their workers compensation insurance premiums.

By utilizing this system, businesses can pay for the exact amount of coverage they need as they go – rather than having to pre-pay for the year in one lump sum. This means that if a company’s payroll changes throughout the year, their premium payments will adjust accordingly. Additionally, because the premium is based on actual payroll, employers will not have to pay more than what’s required and can rest assured that they are paying a fair rate.

Pay As You Go Workers Comp also allows businesses to make payments via ACH or credit cards with no additional processing fees.

Overall, Pay As You Go Workers Comp offers significant financial benefits over traditional workers compensation insurance plans and provides employers with peace of mind knowing that they are only paying what’s necessary to provide adequate coverage for their employees.

What Are The Benefits of Using Pay As You Go Workers Comp for Businesses?

Pay As You Go Workers Comp is an incredibly beneficial option for businesses large and small.

It allows businesses to pay their workers comp premium on an ongoing basis, as it accrues, relieving them of the burden of a lump sum payment.

This means that businesses can budget more effectively, avoiding the financial strain of needing to cover an unexpected bill for their workers comp premiums. Additionally, this type of system offers businesses greater flexibility in terms of how much they need to pay each month.

With Pay As You Go Workers Comp, businesses only have to pay for what they are using at any given time and can adjust their payments easily when needed.

Furthermore, because workers comp premiums are based on current wages rather than the total payroll number, businesses can save money by taking advantage of lower commissions when their employees’ salaries increase.

Finally, Pay As You Go Workers Comp helps create a safer workplace by ensuring that employers are up-to-date with their workers compensation insurance coverage and helping employers make sure that all safety regulations are met.

How Can Businesses Get Started With Pay As You Go Workers Comp?

Businesses can get started with Pay As You Go Workers Comp by consulting a OCMI Workers Comp to find out what their options are.

To get started, businesses should research the best-rated providers and compare their coverage plans, pricing structure, and customer service reviews.

Businesses should also investigate how much coverage they need for each employee and any additional benefits that may be offered with the plan.

Employers should also consider the convenience of setting up automatic payments through the provider to make sure their premiums are paid on time each month.

Ultimately, Pay As You Go Workers Comp provides businesses with an affordable way to stay compliant with workers compensation regulations and protect employees in case of injury or illness while on the job.

Are there any drawbacks to using Pay As You Go Workers Comp?

One of the primary drawbacks to using Pay As You Go Workers Comp is that it can be expensive.

This is due to the fact that employers are required to pay for workers comp coverage on a regular basis and cannot take advantage of lower premiums that may be available if they were able to pay for an annual policy in advance.

Additionally, some employers may not have the cash flow necessary to sustain regular payments and may be unable to afford a comprehensive workers comp policy.

Lastly, not all states allow Pay As You Go Workers Comp, so employers in those states will have no choice but to obtain traditional annual policies or risk getting fined or having their business shut down.

Now that you know all about Pay As You Go Workers Comp, does it sound like something your business could benefit from? If you’re interested in learning more about how OCMI can get you the best workers comp rates, give us a call or fill out our online form to request a quote.

We’d be happy to answer any questions you have and help you get started with this cost-saving solution for your business.

Top Nine Workers Comp Questions

As a business owner, it is important to be aware of the legal risks associated with workers’ compensation. Knowing the answers to the top nine workers comp questions can help protect your business and employees.

What is Workers Comp?

Workers’ compensation serves as an essential safety net for both employers and employees when workplace injuries occur, and understanding the key components of this system is critical.

Here are some of the most frequently asked questions regarding workers’ compensation:

By understanding the answers to these common questions, you can ensure that you are making informed decisions about protecting your business and your employees from financial losses due to workplace accidents.

What Types of Injuries Are Covered by Workers' Compensation?

Workers' compensation covers a wide range of workplace injuries, both physical and psychological. Injuries that are covered include those that are the direct result of an accident or a specific event such as a fall or being struck by an object.

It may also cover repetitive motion injuries caused by long-term repetitive motions such as typing or lifting objects. Additionally, some illnesses may be covered if they can be directly linked to the conditions of your job, such as those caused by exposure to hazardous materials or poor air quality in the workplace.

Mental health issues associated with work-related stressors may also be included in coverage.

For physical injuries, workers’ compensation typically covers medical bills for treatments related to the injury, lost wages due to time off work while recovering, and any necessary rehabilitation costs such as physical therapy.

If the injury leads to permanent disability, coverage may also extend to vocational rehabilitation services and/or payments for any long-term loss of earnings capacity due to the injury. For psychological injuries such as PTSD or depression, coverage typically includes mental health treatment from a professional therapist and medications if prescribed by a physician.

In some cases, workers’ compensation may even cover home modifications needed for someone with a physical disability related to their injury.

When Must an Employer Provide Notice of a Workplace Injury?

Workplace injuries are a common and unfortunate reality of most work environments.

As an employer, it is important to be aware of the legal requirements for providing notice when an employee has suffered an injury on the job.

Generally, employers must provide notice of a workplace injury as soon as practicable after becoming aware of it. In many countries and states, employers may need to report any workplace injuries that require medical attention or results in lost time from work within a certain timeframe.

Depending on the severity of the injury, employers may also be required to take certain other steps including filing reports with federal or state agencies or making worker’s compensation claims.

In addition to having knowledge of these reporting requirements, employers should ensure employees are familiar with their rights in the case of a workplace injury and with the procedures for reporting an incident.

Employers should inform employees about who they should speak to about their injury and what documentation will be necessary for any paperwork related to filing claims or seeking medical attention.

It is also important for employers to have policies in place regarding how workplace injuries will be handled so that all parties involved have clear expectations regarding their responsibilities and liabilities during this difficult time.

Is There a Time Limit on Filing a Claim?

Workplace injuries are a common and unfortunate reality of most work environments. As an employer, it is important to be aware of the legal requirements for providing notice when an employee has suffered an injury on the job.

Generally, employers must provide notice of a workplace injury as soon as practicable after becoming aware of it. In many countries and states, employers may need to report any workplace injuries that require medical attention or results in lost time from work within a certain timeframe.

Depending on the severity of the injury, employers may also be required to take certain other steps including filing reports with federal or state agencies or making worker’s compensation claims.

In addition to having knowledge of these reporting requirements, employers should ensure employees are familiar with their rights in the case of a workplace injury and with the procedures for reporting an incident.

Employers should inform employees about who they should speak to about their injury and what documentation will be necessary for any paperwork related to filing claims or seeking medical attention.

It is also important for employers to have policies in place regarding how workplace injuries will be handled so that all parties involved have clear expectations regarding their responsibilities and liabilities during this difficult time.

How Much Money is Paid Out in Benefits?

Workers compensation benefits, or workman's compensation, are payments made to employees who become injured while on the job.

The amount of money paid out in workers comp benefits varies depending on the type and severity of the injury or illness.

Each state has its own laws that dictate how much an employee can receive in these benefits, but generally speaking, most states provide at least a portion of lost wages and medical expenses for workers with disabilities caused by workplace injuries.

In 2019, the U.S. Bureau of Labor Statistics estimated that workers comp benefits totaled nearly $75 billion in payments and covered close to 8 million claims.

Of this total, nearly $59 billion was spent on wage replacement benefits, with more than $15 billion going towards medical treatment and other costs associated with workplace injuries.

This number is likely to increase as awareness about workplace safety increases and more employers take steps to protect their employees from accidents or illnesses incurred on the job. In addition to providing monetary aid for injured employees, workers comp also helps employers avoid costly litigation fees associated with lawsuits stemming from unsafe work environments.

How Long Do Benefits Last?

Workers’ compensation benefits can last for varying lengths of time, depending on the severity of the injury and its effects.

In most cases, workers’ comp benefits will last until the worker has recovered from their injury and is able to return to their job.

This timeframe can range from weeks to months or even years in more serious cases. If the worker cannot ever fully recover due to a disability, they may be eligible for additional long-term benefits.

When an employee has been injured on the job, they are entitled to a range of medical expenses and wage replacement benefits through workers’ compensation insurance.

These include money for immediate medical care, ongoing medical treatments and physical therapy if necessary, as well as a portion of income while the worker is unable to work.

Depending on the laws in their state, workers may also be eligible for death benefits if a loved one dies as a result of a workplace injury or illness.

The length of these benefits depends on the nature and severity of the injury or illness; some states have maximum lengths for different types of injuries that cannot exceed certain periods of time. For example, many states cap off payments after 400 weeks for permanent disability due to an injury or illness.

Who Pays For Medical Care Related to Workplace Injuries?

Workplace injuries can be devastating and costly, not only in terms of physical and emotional suffering but also financially.

Depending on the severity of the injury, medical care related to a workplace injury may include surgery, medication, rehabilitation, physical therapy or other treatments.

The party responsible for paying for these healthcare costs will vary depending on the circumstances of the injury and the state in which it occurs.

In most cases, employer-provided workers’ compensation coverage pays for medical bills related to a workplace injury.

This coverage is typically provided by the employer’s insurance company; however, some states may have their own workers’ compensation funds that employers must pay into in order to provide coverage. In addition to covering medical expenses related to an employee’s workplace injury, workers’ compensation also covers lost wages while they are recovering from the injury.

In some jurisdictions, an employee may be able to sue their employer if they feel that an inadequate amount was paid out by workers’ compensation. However, this is typically only an option in cases where there was gross negligence or intentional harm on behalf of the employer.

Is There Any Protection Against Potential Litigation When it Comes to Workers’ Comp Cases?

When it comes to workers’ comp cases, employers are required to provide protection for their employees in order to prevent potential litigation. Employers must provide the necessary insurance coverage and comply with the laws governing workers’ compensation.

This includes making sure their employees have access to the compensation they are entitled to and that all of the necessary paperwork is filed correctly. Additionally, employers must also ensure that they are taking all reasonable steps to reduce employee injuries and protect them from harm while on the job.

Employers also need to be aware of any potential legal risks that may arise due to a worker’s compensation claim. In such cases, employers should consult an attorney who specializes in workers’ compensation law in order to understand their rights and obligations under the applicable state laws.

Employers can also look into purchasing Employment Practices Liability Insurance (EPLI) which helps cover potential costs related to lawsuits resulting from employee issues such as discrimination, wrongful termination or sexual harassment.

Additionally, employers should ensure that they are implementing proper training programs and safety protocols within their workplace to minimize liability exposure from potential injury claims made by their employees.

Finally, employers should stay up-to-date on changes in federal, state or local regulations regarding workers’ compensation in order to remain compliant with applicable laws and regulations.

Can An Employee Sue Their Employer For Damages Related to Work-Related Injuries or Illnesses?

Yes, an employee can sue their employer for damages related to work-related injuries or illnesses.

In most cases, employees are covered by workers’ compensation laws which provide access to medical benefits and a portion of lost income in case of an injury or illness related to the workplace.

An employee may also be able to make a personal injury claim against their employer’s insurance in addition to workers’ compensation benefits. This type of claim is necessary when the injury or illness was due to the negligence of the employer or a third party, such as a manufacturer who supplied faulty machinery.

In some cases, an employee may be eligible for punitive damages (in addition to compensatory damages) if it is found that their employer acted with malicious intent, was grossly negligent, or otherwise knowingly endangered their employees without reasonable cause.

Punitive damages are designed to punish employers who have acted unlawfully and sought to prevent future harm from occurring.

Employees should consult with an experienced legal professional before considering any type of lawsuit against their employer as there are specific rules and statutes governing this kind of action that must be followed in order for it to be successful.

What Kind of Evidence Does an Employee Need to Prove Their Case Before The Court?

When an employee takes their case to court, they need to provide evidence to prove their claims. This evidence can take several forms, including witness statements, physical documents or objects, medical or expert witness testimony, financial records and other relevant items.

To be considered legally valid in a court of law, the evidence must generally meet certain criteria. It should be reliable and able to withstand scrutiny by the opposing party’s attorney. It should also be relevant to the claims being made and should be verifiable from multiple sources such as eyewitness accounts or written accounts from official records.

Additionally it should not have been tampered with in any way, as this could weaken its integrity. The employee should also have solid proof that they are the owner of any documents presented to the court and that these documents are authentic.

Furthermore, all witnesses who testify on behalf of the employee must be credible and able to provide testimony that is both convincing and accurate. To ensure that their case is stronger than their opponent’s case, employees should present as much evidence as possible in order for it to stand up under legal scrutiny.

Understanding workers’ compensation laws is important for employers and employees

In conclusion, understanding workers’ compensation laws is important for employers and employees alike.

Knowing the answers to the top nine workers’ comp questions will help ensure that both parties understand their rights and responsibilities regarding workplace injuries. Additionally, it can help employers create a safe work environment for their workforce and provide them with the protection they deserve in case of an unfortunate event.

Furthermore, workers’ compensation policies help protect companies from costly lawsuits that could result from injuries or illnesses sustained on the job. Understanding these benefits makes it clear why it is so important to become informed about all aspects of workers’ compensation law.

All businesses that employ people need to adhere to certain regulations and laws. One of the most important is workers’ compensation, which helps protect both employers and employees if an injury or illness occurs on the job.

In this blog post, we’ll take a look at the workers’ comp requirements in two industries: construction and agriculture.

The construction industry comprises a wide range of businesses involved in the design, building, and maintenance of residential, commercial, industrial, and infrastructure projects.

Common types of businesses in this sector include:

- Engineering firms

- General contractors

- Specialty trades (e.g., plumbers, electricians)

- Manufacturers (e.g., cement producers)

- Architects/designers

- Surveyors/landscape designers

- Material suppliers (e.g., lumberyards)

- Real estate developers/builders

- Demolition companies

Other related services may include landscape architects/contractors; underground utilities providers; fire protection engineers; project managers; site planning consultants; structural steel fabricators; hazardous materials management consultants; public works departments; environmental firms/consultants; security system installers & suppliers; window & door suppliers & installers.

Construction Industry Workers' Comp Requirements

The construction industry has some of the highest rates of workplace injuries in the United States. As such, construction companies must be especially vigilant about making sure they meet their state’s workers’ compensation requirements.

Generally speaking, all construction companies are required to carry workers’ compensation insurance for their employees, as well as any subcontractors or temporary laborers they may use.

If a business fails to provide proper coverage, they can be subject to severe fines and other penalties.

Working in the construction industry can be risky, which is why FL employers must factor workers’ compensation into their payroll.

The construction industry is one of the most dangerous, requiring employers to take a variety of safety measures to protect workers.

In addition to providing proper safety equipment, employers are also responsible for ensuring that their employees are properly covered with workers’ compensation insurance in case of injury.

Workers’ comp provides important protections for both employers and employees, covering medical treatment and lost wages if an employee sustains an injury while on the job. As such, it is imperative that employers ensure they have adequate workers comp coverage for construction in place to protect their workers from potential harm.

Companies should strive to stay abreast of all changes in regulations regarding workers’ compensation requirements so they can remain compliant and safe for everyone involved in the building process.

The agricultural industry is composed of a variety of businesses that grow crops or raise animals for human consumption or other uses such as clothing and fuel production.

Common types of businesses in this sector include farmers who produce crops such as grains like barley and wheat or vegetables like potatoes or carrots as well as grain elevators which store the harvested crops before they are sold to buyers like food processors or other wholesalers.

Other related services may include crop protection companies that sell pesticides or fertilizers to help farmers increase their yields or animal husbandries that raise livestock for meat production.

Additionally agribusinesses such as feed mills may be involved in producing animal feed for ranchers while equipment dealerships provide farmers with tractors or other machinery required for operation.

Agricultural Industry Workers' Comp Requirements

The agricultural industry is another sector where workplace injuries are relatively common, so it’s important for agricultural businesses to understand their state’s workers’ compensation laws.

The exact requirements vary from state to state, but generally speaking, agricultural employers must provide coverage for all full-time employees who work more than 30 hours per week (or 20 hours per week in some states).

In addition, seasonal or part-time employees may also need to be covered, depending on how many hours they work each week and how much money they make.

Why Get Worker's Comp Coverage?

It’s important for business owners in the construction and agricultural industries to understand their state’s workers’ comp requirements so that they can ensure their employees are properly protected in case of a workplace injury or illness.

Not only is this good practice from an ethical standpoint—it can also save businesses time, money, and stress down the road by avoiding costly fines and other penalties associated with not providing adequate coverage.

With that said, every business should consider consulting with a qualified workers comp attorney or insurance agent before making any decisions about their workers’ comp programs. Doing so will help ensure that you stay compliant with your state’s laws while protecting your employees at the same time!

So why not give us a call to discuss whether your company will benefit from our workers comp programs.

Cleaning Companies and Work Related Injuries

Any business owner knows the importance of investing in their employees, and if you’re the proud owner of a cleaning company, then workers compensation should be at the top of your to-do list.

Don’t let a cleaning-related injury get the best of you—learn about some unexpected work hazards and how to guard against them. From slips and falls, to chemical burns and more, here’s what all essential workers should know when it comes to staying safe on the job!

With proper workers compensation coverage, you’ll be lessening the chances of liability and protecting your business from potentially big legal hassles. Plus, having such protection goes a long way towards setting a good example for other employers out there – after all, taking care of our hardworking cleaners is an essential part of running a successful business!

In spite of the physical demands of working for a cleaning company, workers can rest assured that workers’ compensation is widely available. Across the State of Florida, OCMI workers comp has programs that can keep workers safe and ensure they receive the help they need if they incur an injury while on the job.

Without the tireless work of our cleaning heroes, we may just live in a world shrouded by grime. Whether it’s at your office desk or that favorite local café, they keep our spaces sparkling and safe – but often get forgotten about when considering their own health risks. Let us not forget to thank them for making life so much brighter!

Cleaning employees work hard to keep our spaces tidy, but unfortunately they commonly suffer from a few on-the-job injuries. Let’s take quick look at what these hazards might be so we can all help prevent injury and ensure everyone stays safe!

Five Common Cleaning Company Hazards

One of the most common hazards faced by cleaning companies is chemical hazards. Cleaning products often contain harmful chemicals that can cause skin irritation, respiratory problems, and even death if they are not used properly. It is important for cleaning companies to carefully read the labels of all cleaning products and to follow the manufacturer's instructions for use.

Another hazard faced by cleaning companies is electrical hazards. Many cleaning machines, such as vacuum cleaners and floor buffers, use electricity and can pose a serious risk of electrocution if they are not used properly. Cleaning companies should ensure that all electrical equipment is properly grounded and that all workers are trained in how to safely use it.

Another hazard faced by cleaning companies is slip and fall hazards. Wet floors, cluttered rooms, and slippery surfaces can all lead to serious injuries if workers are not careful. Cleaning companies should make sure that all workers wear proper footwear and take precautions to prevent slips and falls.

Another hazard faced by cleaning companies is fire hazards. Many cleaning products are flammable, and fires can easily start if they are not used properly. Cleaning companies should ensure that all workers are trained in fire safety procedures and that all flammable materials are stored in safe areas.

Another hazard faced by cleaning companies is biological hazards. These hazards can include exposure to bacteria, viruses, or other organisms that can cause illness or disease. Cleaning companies should take steps to protect workers from these hazards by providing them with proper training and personal protective equipment

Get Workers' Compensation Today

If you do happen to get injured at work, there’s no need to worry. Most companies offer workers’ compensation, which is insurance that covers medical expenses and lost wages if you’re injured on the job.

So even if you do end up getting hurt, you’ll still be able to receive the treatment you need without having to worry about how you’ll pay for it.

Nothing beats earning a good wage while keeping your health intact, so it pays off to know what workers comp policies are in place at your workplace!

So don’t delay – make sure you get your workers comp set up sooner rather than later and reap the benefits!

Our agents are ready to help you with your workers compensation insurance coverage today. Click on the button below to get your quote today.

According to the Bureau of Labor Statistics, the most common work-related injuries are sprains, strains, and tears. These account for nearly one-third of all nonfatal injuries that occur in the workplace. Many of these injuries are caused by lifting heavy objects, repetitive motions, or falling.

From sprained ankles to pulled muscles, the workplace can be a minefield of potential injury—not to mention costly.

Today, let’s explore four common injuries that occur in the work place and why getting workers compensation insurance coverage is in your best interest.

You know the type. He's the one who slips on a wet floor and sues the company for millions. Or maybe he trips over a loose carpet and ends up with a concussion. Whatever the case may be, there's always that one guy who seems to get injured at work more often than anyone else.

Let's face it, office work might lead to dangerous injuries. You've got paper cuts, carpal tunnel, and the ever-present danger of being crushed by a falling stack of papers. And don't even get us started on the dangers of office chair ergonomics.

Of course, it's not just office workers who are at risk of being injured at work. Those in manual labor jobs are also at a higher risk of injury, due to the nature of their work. From lifting heavy objects to working with dangerous machinery, there are plenty of ways for manual laborers to get hurt on the job.

No matter how careful you are, accidents can happen. Whether it's a slip and fall or a workplace accident, there's always the potential for injury when you're on the job. And while some accidents may be minor, others can lead to serious injuries that could have a long-lasting impact on your health.

Why You Should Get Workers Comp Coverage

Keep your workplace safe and sound with a holistic approach! Make sure that each worker has the right tools, know-how to get their job done safely, and be compliant with all regulations. It’ll help keep everyone protected – so you can avoid any unfortunate incidents down the line.

Get your quick quote today by clicking on the button below.

Workers compensation insurance is an essential form of coverage for any business, but it can be especially important for small businesses.

In the state of Florida, all employers are required to provide workers compensation coverage for their employees. This coverage can help to protect businesses from liability in the event that an employee is injured on the job.

Workers compensation insurance can cover medical expenses, lost wages, and other costs associated with an injury.

For small businesses, this coverage can be vital to protecting the business from a potentially devastating financial loss.

When choosing a workers compensation program, it is essential to work with an experienced agent who can tailor a program to meet the specific needs of your business.

Do I Need Workers' Compensation Insurance for My Small Business?

As stated above – if you have employees in Florida, you are required to carry workers’ compensation insurance coverage. This includes both full-time and part-time employees, as well as temporary and seasonal workers.

The only exception is if your business is exempt from the workers’ compensation law.

To be exempt, your business must meet all the following criteria: have fewer than four full-time equivalent employees, have no out-of-state employees, and be engaged in an exempt occupation.

If your business does not meet all three of these criteria, you must provide workers’ compensation insurance for your employees.

How Much Does Workers' Compensation Insurance Cost For a Small Business?

Workers compensation in Florida typically costs between two and four percent of an employer’s payroll.

The actual amount will depend on the industry, the size of the business, and the claim’s history.

For example, a business with a high rate of workers’ compensation claims will pay a higher premium than one with few claims.

Workers’ compensation insurance is an important part of any business’s risk management strategy.

It helps to protect the business from liability in the event that an employee is injured on the job. In addition, it can help to cover the cost of medical care and lost wages for employees who are unable to work due to their injuries.

As a result, workers’ compensation insurance is an essential part of doing business in Florida.

How Do I Get Workers' Compensation Insurance For My Small Business?

You can obtain workers’ compensation insurance through a commercial insurer (like us), the Florida workers’ compensation system, or self-insurance.

Each option has its own requirements and benefits.

Commercial insurers offer a wide variety of workers’ compensation programs, and the rates will vary depending on the size and type of your business.

The Florida workers’ compensation system is administered by the state, and it offers coverage to businesses that are unable to obtain insurance from a commercial insurer.

Self-insurance is an option for businesses that meet certain criteria, such as having a strong financial history and a good safety record.

When choosing a workers’ compensation programs, it is important to compare the options and choose the one that best meets the needs of your business.

Working in Florida is both an exciting and sometimes, confusing prospect.

A big question workers have is: “Does Florida require workers compensation insurance?” In short, the answer is yes. However, workers comp isn’t required for all workers.

There are certain workers who fit into workers comp exemptions – such as elective officers of municipalities, real estate brokers and salespeople and small business owners with three or fewer employees – so make sure to confirm your particular situation with an appropriate authority.

Prevent On-the-job Injuries Before They Happen

While workers comp is no laughing matter for Florida business owners, the best way to look at it is as an investment rather than a cost.

After all, you can’t put a price tag on preventing on-the-job injuries before they happen. The right safety training and practices can save time, money, and future headaches by protecting workers from accidents that could have been avoided.

Everyone wants a safe workplace – why not start today?

Who Is Exempt From Workers Compensation Insurance in Florida?

Florida business owners are always trying to save a dime, but they overlook being exempt from workers’ compensation insurance at their own risk!

Florida has a set list of exempt workers who include: real estate brokers and sales associates, domestic servants, casual laborers, employees who are members of the employers immediate family.

It is important to note that the more high risk the employee’s work is, the more they should be insured. So while Florida businesses may come across an opportunity to save on insurance premiums by being exempt from workers’ comp, it might be best for them to play it safe instead.

Are Independent Contractors Covered by Workers Comp in Florida?

Florida business owners know all too well that high-risk workers, such as those working in construction and similar labor-intensive industries, face certain dangers on the job. As such, Florida has instituted certain measures to provide compensation to independent contractors who might be injured while performing their duties in the workplace.

While some states do not offer this type of coverage to independent contractors, Florida does provide a mechanism to ensure that these hardworking citizens have access to support should they experience a work-related injury.

The Florida Workers’ Compensation Program offers opportunities for both employers and workers to avail of important resources that can help them get back on their feet following any unfortunate accident or illness related to work.

Why Pick OCMI for Workers Comp Insurance in Florida?

Looking for workers’ comp insurance in Florida? OCMI is the solution: with low rates on program, we make it easier to take care of your team without breaking the bank.

Plus, we offer exemplary customer service and a team of dedicated agents ready to answer any questions or get you set up swiftly and painlessly.

So when you need something done that’s both cost-effective and reliable, why not let OCMI do what it does best? After all, you wouldn’t try to mix margaritas with a wrench, would you?

Ultimately, no joke – workers in Florida should understand their rights when it comes to workers compensation insurance!

Understanding Worker’s Comp Death Benefits

A fatal workplace accident can be tragic and difficult for everyone involved. Workers’ compensation in Florida provides death benefits to the families of deceased employees who died as a result of work-related injuries or illnesses.

The purpose of this article is to explain what these benefits are, who is eligible, and how to apply for them.

What are Workers’ Comp Death Benefits?

Workers’ compensation death benefits provide compensation to families who have lost a loved one because of work-related injuries or illnesses.

The money provided in these benefits can be used to cover funeral expenses, medical bills, and other expenses associated with the death of an employee. Please note that these benefits do not replace lost wages or salaries that the deceased would have earned had they lived.

Do Workers' Compensation Death Benefits apply to everyone?

For an individual to qualify for workers’ compensation death benefits in Florida, certain requirements must be met. In order to qualify, the deceased must have been employed by a Florida business at the time of their death and must have died as a result of an occupational disease (such as mesothelioma).

The family member filing the claim must also prove that they were financially dependent on the deceased at the time of death.

What Are The Steps In Filing A Claim For Workers' Compensation Death Benefits?

To file a claim for workers’ compensation death benefits in Florida, you will need to contact your local Department of Financial Services Division of Workers’ Compensation office with proof of employment and financial dependency.

In the event that your claim is approved, you will receive payment within 30 days of the date your claim was filed. If you disagree with any aspect of your decision, you may appeal to DFS.

Having to deal with unexpected losses caused by work-related injuries or illnesses can be challenging. It is for this reason that we want to remind employers and employees about Florida’s worker’s compensation; so that families can receive some financial assistance during this trying time.